SAGINAW, MI – A proposal to support state legislation to remove all local property tax limits, including the city’s 45-year-old caps on both the rates and revenue, has received the City Council’s backing.

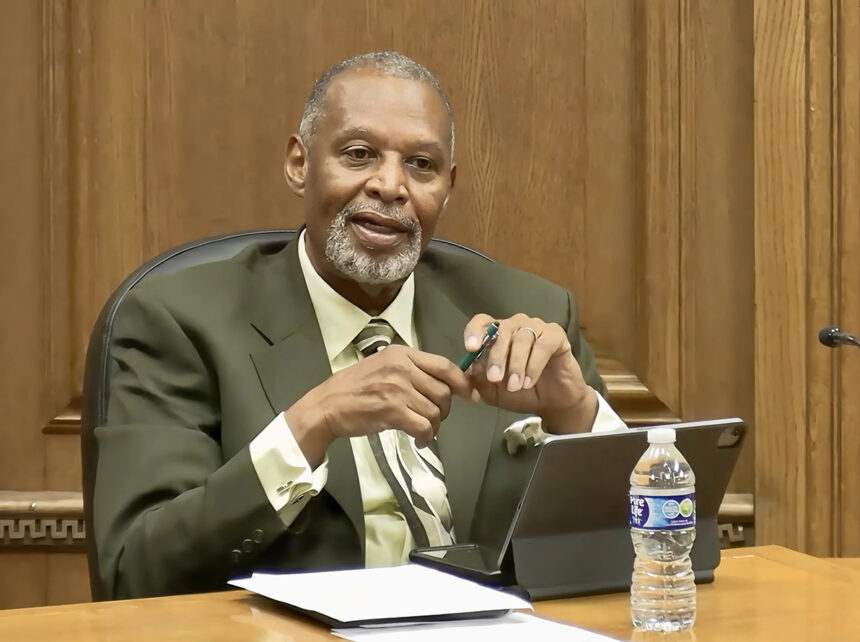

They were surprised by Councilman Michael Balls’ sudden motion on Dec. 9 to move forward, but they voted 8-0 in favor, with newcomer Carly Rose Hammond not in attendance.

They also indicated that if the state action fails, which is likely with Republicans re-taking control of the Legislature, they will place a repeal on the local ballot.

Residents approved the tax caps in 1979 as part of Ronald Reagan’s national anti-government movement that led to his election to the U.S. presidency a year later. The City Charter amendment freezes the rate at 7.5 mills, but more importantly, revenue is iced at $3.83 million, with no adjustment for inflation.

This has caused many tax-cap critics to inaccurately claim city government is forced to “live on a 1979 income,” overlooking the fact that revenue comes from multiple sources other than property assessments. In fact, this year’s general fund is $45 million, compared to $19 million in 1979.

The freeze’s author, attorney Al Schmid, had been an unsuccessful council candidate himself, but citizens embraced the tax cut in following one of the era’s most prominent local politicians, Dr. Walter C. Averill III. City Council members tried several times for a repeal during the 1980s but failed. They switched gears in 1989 and won support for a 50 percent hike in the income tax rate, which has remained in place since then with no requirement for renewal referendums.

The city’s revenue cap has pushed this year’s rate down to 6.7 mills. The City Charter’s maximum allowable rate was 10 mills prior to the 1979 referendum, which means a vote to remove the tax caps could lead to an increase up to 3.3 mills. In comparison, the latest school bond for Saginaw United High and other improvements is 6 mills and a new countywide roads levy is 2 mills.

The original 1964 city income tax rate was 1 percent for residents, 0.5 percent for non-residents who work in the city. The 1989 increase raised the shares to 1.5 and 0.75, among an array of ways that leaders through the years have avoided the most damaging impact. Other tax-cap-dodgers have been:

- A separate tax for rubbish pickup was 3 mills before higher-value property owners achieved a switch to a flat fee that this year has reached a new annual peak of $240.

- A 7.5-mill special assessment to help avoid more cuts in police and fire, approved in 2005 and renewed in landslide votes, causing confusion and consternation on reasons for residents to reject rescinding the caps, while backing a special purpose millage for a larger sum of money.

- The Civic Center was removed from the city’s general fund with a countywide tax of 0.45 mill.

- Transit was pulled from the budget with creation of STARS, Saginaw Transit Authority Regional Services, which has unsuccessfully aimed to go countywide like the Civic Center, now The Dow, and thus must rely on a city-only levy of 3.2 mills. A single 1 mill in the city limits raises only $650,000 with the local demise of General Motors, while the same rate countywide produces $6.5 million.

Behind the scenes, talk of trying to lift the property caps again, after a three-decade hiatus, returned while Floyd Kloc, the former city attorney, was Brenda Moore’s mayoral predecessor. Kloc’s view has been that the best chance to persuade voters will be if a cap-cut proposal is initiated by a citizens’ advocate group, not from the City Council on high. This outlook has led to nothing being placed on the ballot until Balls’ call to action.

More discussion is likely during the council’s annual planning session at 9 a.m. on Jan. 31, a Friday.