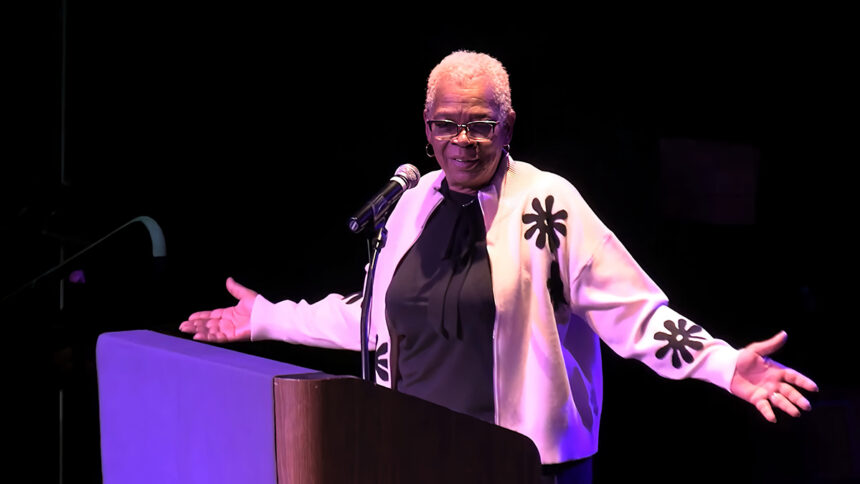

SAGINAW, MI — As the City Council considers a public vote to remove longtime property tax cap limits, Mayor Brenda Moore is avoiding the misstatements of her predecessors.

Inaccurate statements that City Hall is “living on an income based on 1979 prices” have prevailed over the years, including from past mayors Dennis Browning and Floyd Kloc. This line was included in the script of her Feb. 6 “State of the City” remarks, prepared in tandem with city staff, but she eliminated it from her address to the Chamber of Commerce because she found it to be misleading.

Property taxes are less than 10 percent of a general budget that also includes income taxes, fees and federal/state aid, and so the city is not living on 1979 fund levels.

In fact, the annual general fund budget was less than $24 million in 1979 and has risen to $44 million currently. Inflation has jumped prices more than quadruple since then, according to the U.S. Department of Labor Statistics. City Hall indeed has lost purchasing power through the years, the same as numerous other families and local governing units, especially during the banking/housing crisis in 2008 and then the prime covid years. These are in addition to General Motors and smaller industries leaving town, but Saginaw is far from being forced to budget on a 1979 basis.

Specific dodge-the-caps revenue increases during the years after the “frozen income” include:

- 1980, trash is pulled from the budget, setting a separate new millage, now a fee, for pickup.

- 1989, after repeated voter defeats to remove the ’79 caps, a change in strategy leads to citizen approval of a 50 percent city income tax increase.

- 1994, transit is pulled from the budget, setting a separate new millage through STARS.

- 2000, the Civic Center is pulled, setting up a separate new millage, this one countywide, teamed with Dow Chemical sponsorship.

- 2006, a portion of public safety is pulled, in favor of a 7.5-mill special assessment approved by voters.

City leaders have focused on the police/fire tax, even remaining silent on the tax caps in caution until the millage — slightly higher than the Saginaw United school bond — quietly was renewed a year ago in a small mid-winter special election.

The cap revenue limit is $3.83 million, which has forced a general reduction of less than 1 mill over nearly a half-century, much from recent rises in home property assessments. Advocates of removal estimate a 46-year loss of a combined $28 million, or $600,000 per annum, or 1.3 percent. Far larger setbacks have been caused by industrial decline, led locally by General Motors, along with big losses of federal and state revenue sharing.

Skip a public vote?

Mayor Moore continued in her full address: “The city is working with state legislators to find ways to ease these restrictions. I appreciate the support of our legislators and their efforts to fight for us in Lansing.”

This refers to a push among Democrats in Lansing, including Rep. Amos O’Neal with his past experience on the City Council and County Board, to address local tax limits enacted by political conservatives through the years statewide. Many, including Saginaw’s, were inspired during Ronald Reagan’s ascending years as a California Proposition 13 tax-slasher.

Members of the previous City Council expressed enthusiasm for O’Neal’s initiative, similar to what the mayor showed at The Dow breakfast event inside a packed Unity Hall, even with the prospect of denying citizens an up-or-down vote on the charter amendment for the tax caps. Usually local officials oppose state and federal mandates, but not in this case.

Since then, however, two drawbacks have emerged:

- Republicans took a majority in the Legislature on Donald Trump’s coattails in November.

- Furthermore, City Manager Tim Morales informed the council during the close of the Jan. 31 daylong planning session that the state legislation, if somehow still adopted, would remove only the revenue cap, not the millage rate limit. (The city would thus gain a mere $500,000, as opposed to $2.2 million from getting rid of both cap limits.)

And so the process is on track for a “lift-the-caps” referendum at an undetermined date, which would add a potential rounded-off 3.3 mills, roughly half of the Saginaw United/Handley/SASA school bond from 2020.